“The man who won’t read has no advantage over the man who can’t read.” – Mark Twain

As an educator, we learn early on that reading, the ability to connect meaning to printed language, truly is a science. We also learned that reading well is an art that then can project us forward and into careers and opportunities. Interestingly, when Johnson O’Conner did the background work in the 1920’s as development of the Highlands Ability Battery, a test of natural abilities used to assist in understanding self and career matches, they discovered a link between vocabulary level and level of career achievement.

When kindergarteners enter school having been read to regularly, they typically out perform their peers who have had less reading and language exposure. Over a period of weeks and months the achievement of each group becomes dramatically evident…..rather like interest compounding daily in a bank or investment portfolio. The readers are able to attach meanings more quickly and therefore success builds on success. The non-readers continue to struggle with initial learning of letters, sounds and word formations. The gap grows.

The need to read is vital for success in school. But it continues to play out the influence throughout our lives. The more broad our vocabulary, the greater our ability to provide effective communication. Reading just 15 minutes a day can provide incredible on-going vocabulary building. Find a book, find the time, invest in yourself. As Mark Twain said, “The man who won’t read has no advantage over the man who can’t read.”

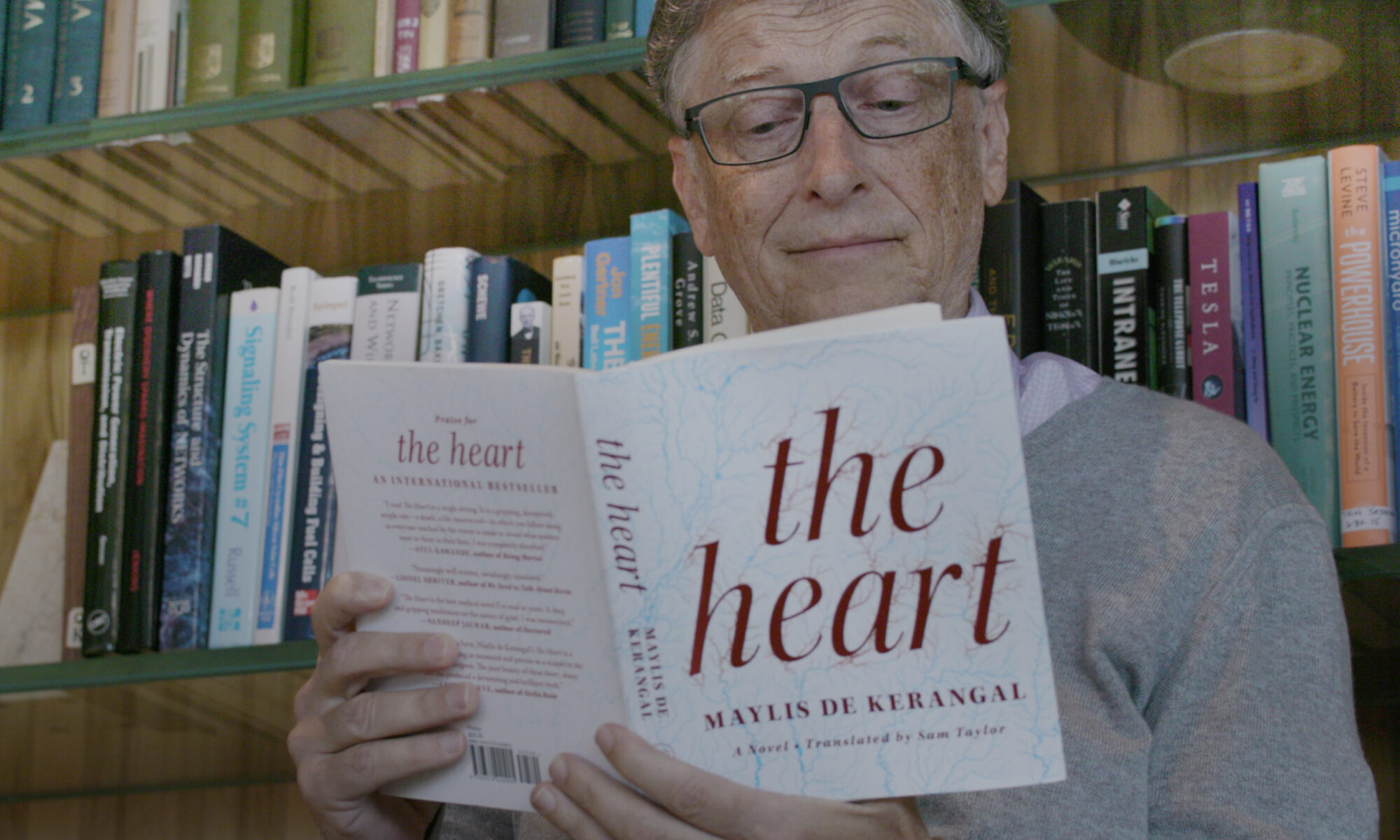

One of the Top Ten Things Successful People Do as evident in many surveys over the years, is reading. Yep, 30 minutes a day devoted to reading. Whether it is self improvement, business, industry specific, biography, autobiography, fiction, non-fiction…..read! In fact, it has even appeared as an interview question, “What are you currently reading?” as an indicator of motivation, self improvement, cultural fit to the organization.

So, what are you reading?